Precious metals, including gold, silver, platinum, and palladium, have long been recognized for their value and significance in both the financial markets and various industrial applications. While historically treasured as stores of wealth, these metals also play a crucial role in advancing modern economies through their industrial uses. The dual significance of precious metals—serving as both valuable investment assets and vital materials in numerous industries—makes them uniquely positioned to impact the economy in multiple ways. This article explores the financial and industrial significance of precious metals, examining their role in investment markets and their diverse applications in industries like electronics, automotive, healthcare, and more.

The Investment Role of Precious Metals

For centuries, precious metals have been seen as safe-haven investments, a stable store of value during times of economic uncertainty. As global financial markets fluctuate, investors often turn to precious metals as a hedge against inflation, currency devaluation, and geopolitical instability. Their intrinsic value, scarcity, and historical significance make them an attractive option for diversifying investment portfolios and preserving wealth.

1. Precious Metals as a Hedge Against Economic Uncertainty

Precious metals are widely regarded as a reliable safeguard in times of economic instability. When inflation rises or financial markets experience volatility, the value of traditional paper assets can decrease, but precious metals, particularly gold, often retain or even increase their value.

How precious metals perform during times of economic instability:

- Gold: Known for its historical role as a store of value, gold is often the first choice during economic downturns. It has an inverse relationship with the U.S. dollar, often rising in value when the dollar weakens.

- Silver: Although more volatile than gold, silver also acts as a safe-haven asset, benefiting from both investment demand and industrial applications.

- Platinum and Palladium: These metals are often seen as an alternative investment to gold and silver, with demand driven by both industrial uses, such as automotive catalysts, and their scarcity.

2. Portfolio Diversification

In addition to acting as a hedge, precious metals serve an important role in diversifying investment portfolios. Their performance often differs from traditional equities and bonds, making them an effective tool for risk management. By including precious metals in their portfolios, investors can reduce the overall risk associated with market fluctuations.

How precious metals contribute to portfolio diversification:

- Low correlation with other asset classes: Precious metals tend to have low correlations with traditional stocks and bonds, meaning they often perform well when other assets are underperforming.

- Long-term growth potential: The historical upward trend in the value of gold and silver makes them appealing for long-term investors seeking to build wealth over time.

- Liquidity: Precious metals are highly liquid, meaning they can be easily bought and sold in markets around the world, offering flexibility to investors.

3. Market Speculation and Futures Trading

Beyond long-term investment, precious metals also play a significant role in speculative trading. Futures contracts, options, and exchange-traded funds (ETFs) allow investors to gain exposure to precious metals without having to physically own them. These financial instruments enable traders to capitalize on short-term price movements, adding a layer of complexity and opportunity to the precious metals market.

Speculative opportunities in the precious metals market:

- Futures contracts: These allow traders to agree to buy or sell precious metals at a predetermined price at a future date, offering an opportunity to profit from price movements.

- ETFs: Exchange-traded funds allow investors to invest in precious metals without dealing with physical storage, making it easier for individuals to diversify their portfolios.

- Options trading: Options contracts give investors the right, but not the obligation, to buy or sell precious metals at a specific price, adding a layer of flexibility for short-term trading strategies.

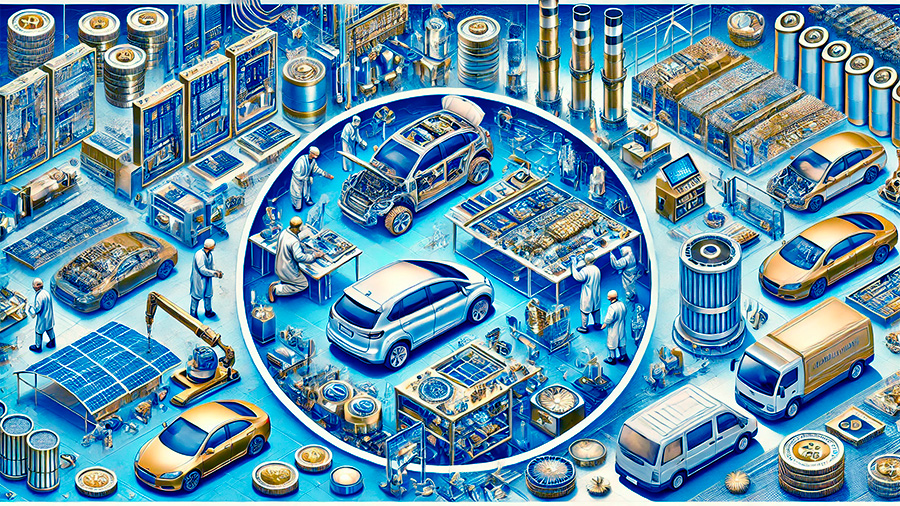

The Industrial Use of Precious Metals

While precious metals are highly valued in the financial world, their industrial uses also have a profound impact on modern economies. These metals are critical components in various sectors, including electronics, automotive manufacturing, medical devices, and renewable energy technologies.

1. Electronics and Technology

Precious metals like gold, silver, and palladium are essential in the electronics industry due to their excellent electrical conductivity, corrosion resistance, and durability. These properties make them ideal for use in the production of everything from smartphones and computers to circuit boards and connectors.

The role of precious metals in electronics:

- Gold: Gold is used in electronic components, including connectors, circuit boards, and microchips, because of its excellent conductivity and resistance to oxidation.

- Silver: Silver is the best conductor of electricity, making it indispensable for use in solar panels, electrical circuits, and components in consumer electronics.

- Palladium: Palladium is used in multi-layer ceramic chips and electronic connectors, playing a critical role in the miniaturization of electronic devices.

2. Automotive Industry and Catalysts

Precious metals, particularly platinum, palladium, and rhodium, are crucial to the automotive industry. These metals are used in catalytic converters, which reduce harmful emissions from vehicle exhaust. As environmental regulations become stricter, the demand for these metals has increased, especially in the production of vehicles with low carbon emissions.

The role of precious metals in automotive manufacturing:

- Platinum: Platinum is used in catalytic converters to help reduce harmful pollutants like carbon monoxide, hydrocarbons, and nitrogen oxides from vehicle emissions.

- Palladium: Palladium is another critical component in catalytic converters, particularly for gasoline-powered vehicles, helping to reduce environmental pollution.

- Rhodium: Rhodium, often used alongside platinum and palladium, plays an important role in further reducing harmful emissions in diesel engines.

3. Healthcare and Medical Devices

Precious metals are widely used in medical devices and healthcare applications due to their biocompatibility, non-reactivity, and strength. Gold and platinum are often used in dental work, surgical instruments, and implants, while silver has antimicrobial properties, making it valuable in wound care and medical coatings.

The role of precious metals in healthcare:

- Gold: Gold is used in dental crowns, implants, and medical devices like pacemakers due to its non-reactivity and ability to withstand wear and corrosion.

- Platinum: Platinum is utilized in a variety of medical applications, including chemotherapy drugs, as well as pacemakers and other implantable medical devices.

- Silver: Silver’s natural antimicrobial properties make it useful in wound care products, medical coatings, and surgical instruments.

4. Renewable Energy and Green Technologies

Precious metals also play a pivotal role in the renewable energy sector. Silver, platinum, and palladium are integral in the production of solar panels, hydrogen fuel cells, and other clean energy technologies. As the world transitions to greener energy solutions, the demand for these metals continues to rise.

Precious metals in renewable energy applications:

- Silver: Silver is used in solar panels due to its high electrical conductivity, which helps increase the efficiency of energy conversion in solar cells.

- Platinum: Platinum is key in the development of hydrogen fuel cells, which are used to store and convert energy in a more sustainable way.

- Palladium: Palladium is used in fuel cell technologies and other energy storage systems, contributing to the development of cleaner and more efficient energy solutions.

Balancing the Financial and Industrial Demand for Precious Metals

As demand for precious metals continues to rise in both financial markets and industrial applications, balancing these two competing interests will become increasingly important. The price of precious metals is often driven by speculative investments, while industrial demand tends to be more stable, albeit subject to economic cycles. However, as new technologies in electronics, automotive manufacturing, and renewable energy emerge, industrial demand for these metals will likely continue to increase.

1. Supply Constraints and Future Challenges

The limited availability of precious metal reserves means that both investors and industries must compete for access to these valuable resources. As a result, supply constraints could lead to price volatility, especially as new applications for these metals emerge. Managing these supply-demand dynamics will require continued investment in mining, recycling, and alternative materials.

2. Opportunities for Recycling and Sustainability

Recycling precious metals presents an important opportunity to address supply shortages and reduce environmental impact. Many precious metals, such as gold and silver, can be recycled repeatedly without losing their value, offering a more sustainable source of these materials. Innovations in recycling technology could help meet the growing demand for both industrial and investment uses of precious metals.

Conclusion

Precious metals, with their dual roles in both financial markets and industrial applications, are pivotal to the functioning of modern economies. While they serve as a critical investment vehicle, providing stability and protection against economic uncertainty, they are also indispensable in various industries, from electronics to renewable energy. Balancing these demands and ensuring a sustainable supply of these metals will be crucial for the continued growth and stability of global markets. As technologies advance and new uses for precious metals emerge, their importance in shaping both economic and industrial futures will only continue to grow.